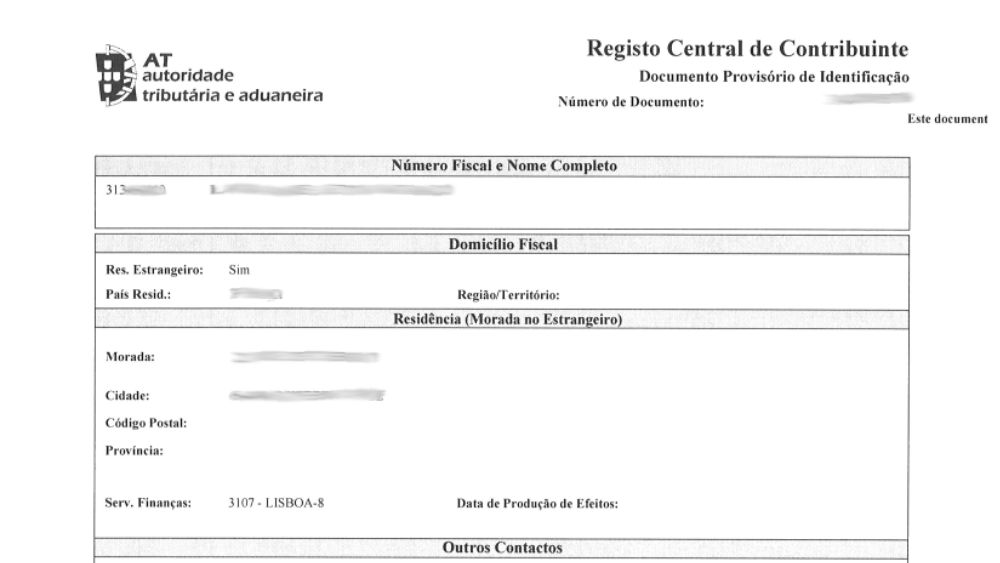

The NIF, standing for Número de Identificação Fiscal, is Portugal's Tax Identification Number. It's indispensable for both residents and non-residents, playing a critical role in various administrative tasks.

It's assigned to individuals and businesses in Portugal.

Necessary for functions such as opening a bank account, making purchases, availing services, and undertaking official processes.

Allows tax authorities to track your fiscal activities in Portugal, thereby ensuring proper taxation.

The significance of the NIF extends beyond tax implications.

Taxation: Ensures you're correctly taxed and prevents tax evasion.

Financial Transactions: A must-have for most monetary interactions in Portugal.

Legal Obligations: Essential for any legal procedures or property ownership in Portugal.

Everyone engaged in financial activities or with legal obligations in Portugal needs a NIF.

Portuguese citizens

Expatriates and Digital Nomads

Foreign businesses operating in Portugal

Non-residents owning property or assets in Portugal

Understanding the process of obtaining a NIF can ease your transition into Portuguese life.

EU/EEA residents: No fiscal representative required.

Non-EU residents: A fiscal representative is essential. This can be anyone who's a tax resident in Portugal. They aren't necessarily lawyers but should be well-acquainted with Portuguese taxation. This is exactly what we help you do.

Online Services: Our service Residency Solutions allows for easy online registration.

In-Person: Visit a Finanças office or our service Juntas de Freguesia for hands-on assistance.

Valid Passport (or ID for EU citizens)

Proof of Address: This can be a bank statement, utility bill, or a relevant document verifying your residence.

For individuals looking to establish a business, you might also want to look into Company Formation.

Securing a NIF can be a unique experience based on various factors.

Location Matters: Major cities like Lisbon can have longer queues. Arriving early and grabbing a senha (ticket) can expedite the process.

Language: While some offices might have English-speaking staff, displaying efforts to communicate in Portuguese can be beneficial.

Below, we'll address the most common questions about the NIF.

Foreign Address: There's no strict requirement for utilities or internet services to have a Portuguese address.

Display: Though physical NIF cards are no longer issued, proof can be retrieved from the e-fatura website.

Lost NIF: If in Portugal, visit a Finanças office. If abroad, contact the nearest Portuguese embassy or consulate.

Changing Address: Update your details on the Portal das Finanças website.

NIF for Kids: Essential for school enrollments, though they aren't automatically assigned at birth. Each individual has a unique NIF.

Leaving Portugal: You cannot cancel your NIF. If you've departed and have no tax obligations post-2022, an ongoing fiscal representative isn't mandatory.